What Are Small Amount Payments?

Small amount payments refer to transactions that involve minimal monetary exchanges, typically for goods or services with low price points. These payments often cater to everyday purchases, such as coffee, snacks, or digital content. In the digital age, the rise of mobile payment systems and e-commerce platforms has facilitated the ease of making small transactions. This trend is particularly evident in the growing popularity of micropayments, which allow consumers to pay small amounts for online content, apps, or services without the burden of traditional payment methods like credit cards or cash.

Small amount payments have evolved significantly with technology. Initially, cash was the primary medium for small transactions. However, with the advancement of digital wallets, contactless payments, and mobile apps, consumers can now make quick and easy payments without the hassle of carrying cash. This shift not only enhances convenience but also encourages spontaneous purchases, thus driving sales for businesses that rely on high volumes of low-value transactions.

Benefits of Small Amount Payments

One of the main advantages of small amount payments is their convenience. For consumers, they provide a hassle-free way to make quick purchases, especially for items that don’t warrant the use of larger payment methods. For instance, buying a coffee or a magazine can often be completed with just a tap on a smartphone or a swipe of a contactless card. This immediacy caters to the fast-paced lifestyle of modern consumers who value efficiency.

From a business perspective, small amount payments can lead to increased sales volume. By lowering the barrier to purchase, businesses can attract a broader customer base, including those who may hesitate to spend a significant amount on a single item. This can be particularly beneficial for startups and small businesses that rely on high transaction frequencies to achieve profitability. Additionally, these transactions can enhance customer loyalty, as easy and quick payment options often lead to repeat business.

Challenges of Implementing Small Amount Payments

Despite their numerous benefits, small amount payments are not without challenges. One of the primary issues is the cost of processing these transactions. Many payment processors charge a flat fee per transaction, which can eat into the margins of low-cost items. For instance, if a payment processor charges a dollar fee for each transaction, it becomes economically unfeasible for a business selling items priced at two dollars or less.

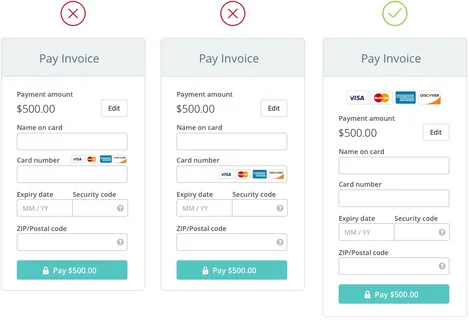

Moreover, the infrastructure required to support these payment systems can be complex. Businesses must invest in technology that can handle various payment methods, including credit cards, mobile payments, and digital wallets. This can be a significant upfront cost, particularly for smaller retailers or service providers. Furthermore, there are also security concerns associated with digital transactions. As the volume of small payments increases, so does the potential for fraud, necessitating robust security measures to protect both businesses and consumers.

The Future of Small Amount Payments

Looking ahead, the future of small amount payments appears promising, driven by ongoing technological advancements and changing consumer preferences. The rise of cryptocurrencies and blockchain technology presents new opportunities for facilitating small transactions. These technologies can provide a decentralized approach to payments, reducing fees and increasing transaction speeds.

Additionally, as consumers become more accustomed to digital payment methods, the demand for seamless, fast, and secure small amount payment options will likely continue to grow. Businesses that adapt to these trends by integrating innovative payment solutions into their operations stand to gain a competitive edge. Furthermore, as the gig economy expands, freelancers and service providers may increasingly rely on small amount payments for their services, reinforcing the need for efficient payment systems.

In conclusion, small amount payments are transforming the way consumers and businesses interact in the marketplace. While there are challenges to overcome, the benefits of convenience, increased sales volume, and evolving technologies present significant opportunities for the future. As this payment model continues to evolve, both consumers and businesses must stay informed and adaptable to fully harness its potential.상품권소액결제